Bond Yield, Accrued Interest, Convexity, and More.

Overview: DIH provides end-of-day bond yield analytics for global government & corporate bonds, along with the relevant reference data and price data. Our analytics include:

- Yield

- Yield to Maturity

- Yield to Call

- Yield to Put

- Yield to Worst

- Accrued Interest

- Macaulay Duration

- Effective Duration

- Modified Duration

- Key-Rate Duration

- Convexity

Coverage: Our bond analytics covers over 150,000 debt securities from around the world, including government, corporate, fixed-rate, floating, and convertible bonds.

History: We have bond yield, yield to maturity, accrued interest, convexity, duration, and more analytics going as far back as 2014.

Updates: We update our data daily.

Delivery: You can receive our data in bulk files via download, S3 to S3, or on-demand via API.

License Terms: We license our data for either your internal use only or for display/redistribution to your clients. Unlike other data providers, DIH does not have purge clauses – so if you ever stop receiving data from us, you do not have to a ransom to keep the data you’ve already received and for which you’ve paid.

Pricing: Several inputs go into the pricing for our data. For example, do you want bond yield analytics for all available debt securities or a subset? How much history do you want? Do you want updates going forward? Contact us to learn more.

Why Firms Choose Our Bond Yield Analytics.

Institutional participants in the fixed income markets choose to source their data from DIH for several reasons:

Proven Models – The models used to calculate our bond yield analytics have been thoroughly tested and vetted.

Variety of Metrics – We offer 11 metrics in our bond yield analytics.

Geographic Coverage – We offer analytics for over 150,000 debt securities from around the world.

Complete & Accurate Data – To ensure the highest quality bond yield analytics possible, all of the bond prices, security reference data, and corporate actions that feed into our models are checked both algorithmically and manually reviewed before they are made available for download.

Flexible Licensing Terms – DIH licenses its data for internal use or for display/redistribution. We also do NOT have any purge clauses like many data providers. So if you ever cancel your subscription, you do not need to delete the data you’ve already downloaded.

Affordable Pricing – Despite the high quality of our data, we still try very hard to work within our clients’ budgets.

What’s Included in Our Data.

DIH provides end-of-day bond yield analytics for global debt securities, including:

- Government bonds

- Corporate bonds

- Fixed-rate issuances

- Floating issuances

- Convertible issuances

Our analytics include the following:

Yield – the return an investor realizes on a bond.

Yield to Maturity – the total rate of return that will have been earned by a bond when it makes all interest payments and repays the original principal.

Yield to Call – the return an investor receives if the bond is held until the call date, which occurs sometime before it reaches maturity.

Yield to Put – the yield at which an investor will put the bond back (sell the bond) back to the issuer.

Yield to Worst – a measure of the lowest possible yield that can be received on a bond with an early retirement provision.

Accrued Interest – the amount of interest earned on a bond, but not yet collected.

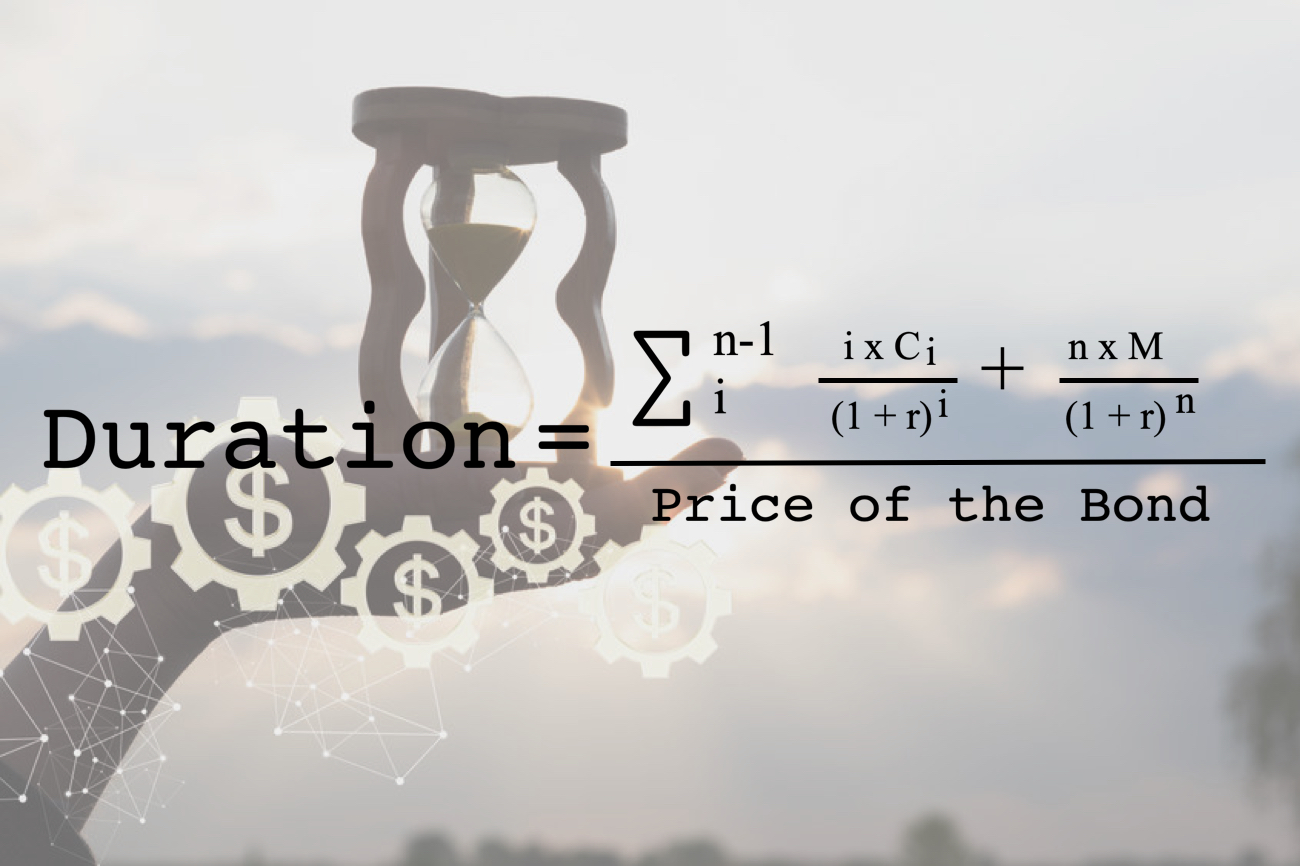

Macaulay Duration – the weighted average term to maturity of the cash flows from a bond.

Effective Duration – a duration calculation for bonds that have embedded options and that takes into account the fact that expected cash flows will fluctuate as interest rates change.

Modified Duration – following the concept that interest rates and bond prices move in opposite directions, this formula is used to determine the effect that a 100-basis-point (1%) change in interest rates will have on the price of a bond.

Key-Rate Duration – the change in a bond’s price in relation to a 100-basis-point (1%) change in the yield for a given maturity.

Convexity – a measure of the curvature, or the degree of the curve, in the relationship between a bond’s price and its yield, and that demonstrates how the duration of a bond changes as the interest rate changes.

REFERENCE & PRICE DATA FOR THE UNDERLYING SECURITY

With our bond yield analytics, we include relevant reference data for the underlying security, such as:

- Standard identifiers (e.g. ISIN)

- Issuer Name

- Security Description

- Country of Incorporation

- Issue Date

- Issue Price

- Bond Type

- Bond Currency

- Nominal Value

- Outstanding Amount

- Interest Type

- Interest Rate

- Interest Payment Frequency

- Interest Accrual Convention

- Floating Rate Note (FRN) Index Benchmark

- Markup

- Maturity Date

- Maturity Price as Percent

- Call/Put Flag

- Call/Put Type

- Callable From/To Date

- Call Price

We also include price information about the underlying security, including:

- Market Close Date

- Last Trade Date

- Closing Price

- Price Currency

- Open

- High

- Low

- Mid

- Ask

- Bid

- Bid Size

- Ask Size

- Traded Volume

- Settlement Date

- Exchange Code

Who Can Benefit from DIH’s Bond Yield Analytics?

Because such analytics are so important to anyone participating in the fixed income markets, a wide variety of firms rely upon our data, including:

- Investment banks

- Brokerage firms

- Hedge funds (systematic & non-systematic)

- Asset managers

- Proprietary trading firms

- High net worth investors

- Service providers (e.g. OMS, EMS, data vendors, etc.)

How DIH Clients Use Our Data.

Institutional investors use our bond yield analytics for various tasks, including:

- Manage the risk associated with their fixed income portfolios

- Project individual security or portfolio returns

- Back-test trading strategies

- Comply with regulatory requirements

No matter what the use case, having accurate bond yield analytics is crucial.

Flexible Updates & Delivery.

Our bond yield analytics are updated on a daily basis and the file is delivered the next day at approximately 8 am (GMT).

You may customize our data to best suit your needs. For example, specify the instruments for which you’d like to receive data. Also, choose how much historical data you’d like, and whether you wish to subscribe for updates going forward.

We deliver our data in bulk files. We can deliver files in various formats (e.g. CSV) via download, S3 to S3, or on-demand via API.

Bond yield analytics for global government & corporate bonds.

Bond yield analytics for global government & corporate bonds.